- admin

- February 1st, 2026

- admin

- June 26th, 2024

How choosing the right iPhone can make you wealthier by Rs. 25 Lakhs?

Getting Wealthy requires a change in spending mindset. Chasing after the latest, fastest, greatest, biggest material things money can buy, will never let you grow your station in life. This does not mean you deprive yourself and stay a saint while you invest all your money. As with most things in life, spending vs investing is all about balance.

But even a small mindset change can make wonders in the long-term.

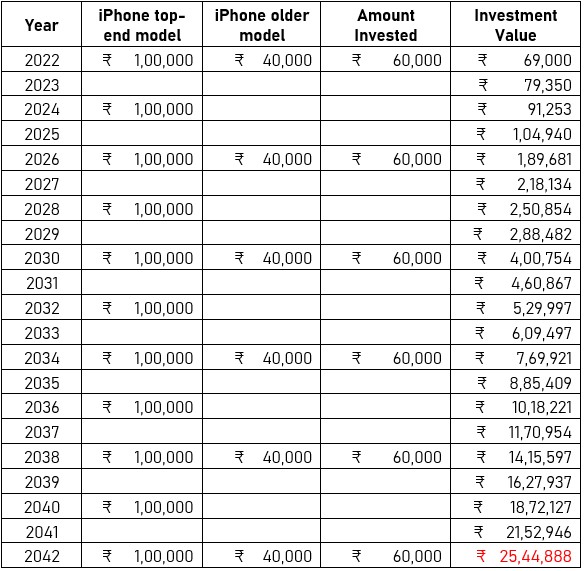

Imagine the following two scenarios:

Scenario 1:

You always like to buy the latest top-end iPhone models. But you get bored after 2 years and exchange it for the newest model every alternate year. Let’s assume (for the sake of simplicity) that this top-end iPhone costs Rs. 1 Lakh.

Scenario 2:

With a small mindset change, you decide to buy a slightly older iPhone model, now available at a discount for say, Rs. 40,000. And you replace the phone only once in 4 years.

But with a slight twist – you invest the balance Rs. 60,000 in a mutual fund. Let’s assume this fund gives a 15% annualized return. If you continue with this ‘habit’ for 20 years, you’ll end up with Rs. 25 Lakh in hand!

Illustration:

ow choosing the right iPhone can make you wealthier by Rs. 25 Lakhs?

Fascinating, isn’t it?

Of course, we’ve made some assumptions for simplicity, such as the cost of the iPhone remaining the same over 20 years, but the broader point about the mindset change required to balance spending with wealth-building still holds true!

The first step to making this mindset change is to track your income vs expenses. The Personal finance Tracker excel in the link below is a good place to start.

Click here to download the Personal Finance Tracker Excel

The next step is to plan for your future money requirements and start investing with clear goals.

The way I define my affordability for my ‘wants’ such as an iPhone is as follows:

- As soon as I receive income in my bank account, I pay myself first – by investing.

- Then I pay my bills and other fixed monthly expenses – for my needs.

- Then I save a little bit towards short-term expenses that I’m likely to incur within the year

- What’s left is my splurge budget! I spend on my wants from this budget. If I want something bigger, I save up monthly from this budget and spend only from that.

For a FREE review of your personal finance situation, and to get started on your path towards financial independence, fill up the above excel and e-mail it to us at: finandme.finance@gmail.com