About Us

Fin and Me Wealth Partners LLP is a limited liability partnership firm registered with the Ministry of Corporate Affairs, India. We are here to help you achieve Financial Independence and Time Freedom.

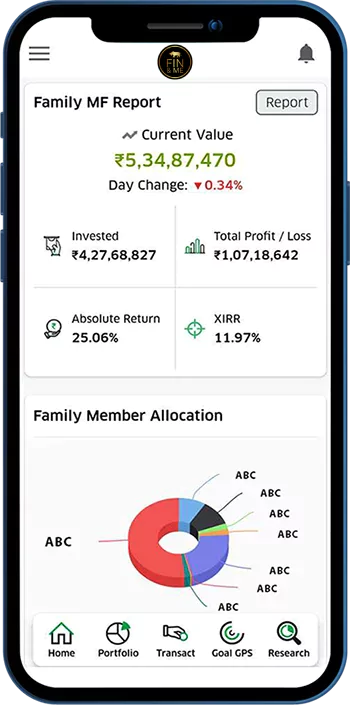

About usAssets Under Management (₹ Crores)

Happy Clients

SIP Book (₹ Lakhs)

Top 10 MFD (Startup India)

Fin and Me Wealth Partners LLP is a limited liability partnership firm registered with the Ministry of Corporate Affairs, India. We are here to help you achieve Financial Independence and Time Freedom.

About usAs India progresses towards a $10 Trillion economy, our vision is to ensure sufficient financial literacy and financial inclusion for normal retail investors to tap into this growth.

Our mission is to assist you with the right choice and mix of investment products relevant to your financial goals, aligned to your ability and necessity for risk, with proper porfolio-level risk and returns management.

We are here to help you improve your relationship with money. We help you with end-to-end money management and investment services – helping you spend mindfully, save and invest for your long-term goals, and help you navigate the road towards financial independence - acting as your life-long investment and wealth partner.

We appreciate clients who have a long-term horizon to achieve their wealth goals; and have the ability to avoid temptations of instant gratification in favour of long-term wealth building.

We are not ideal for clients who look at the stock market as a place to gamble and get rich overnight.

We appreciate clients who understand that their savings rate will have the highest impact on their wealth creation over the long-term.

Working with Fin and Me has been a unique and refreshing experience for me, especially because of the personalized money management advice offered. They always ensure to put in extra effort to simplify complex investment options, in such a way that anyone can understand it fully, before opting for it. I’m more confident of reaching my FIRE goals now with the partnership of Fin & Me.

The team at Fin & Me helped me move from a negative cycle of EMI outgo to becoming debt-free, and start a positive cycle of SIP investments - that now go towards building a corpus for my retirement goals and my daughter's education. This has made me feel much more confident about my financial future.

While my wife and I were already investing blindly in mutual funds solely for the purpose of tax savings, it was in discussion with Fin & Me that we realised the importance of goal-based investing. We were guided all through the way from identifying unnecessary expenses on credit cards to setting up a customised investment plan for both of us.

While investing in stocks and mutual funds, I always focused on short-term returns and used to exit them when they didn't perform to my expectations or when I made a desirable “profit.” After speaking to Fin & Me, I realized the value of SIPs tied to financial goals, long-term compounding and reducing risk through asset allocation and rebalancing.

I have never thought seriously about having to “manage” money. I used to spend from my credit card and somehow, somewhere the income and expenses reconciled some day. Fin & Me’s Cash Flow Tracker helped provide a structure for monthly money management and it was clear how much I could save. I am now investing systematically towards my goals.

I’ve never been a spendthrift, yet I had no idea whether I was efficiently investing for my future. Talking to Fin & Me, I’m highly impressed by their in-depth knowledge and the effort they put in making me understand. They don’t scare you; they help you to get ready to take those crucial next steps towards investing.

I've known the folks at Fin & Me for a while. I used to ask LK to manage my money, and he would say, some day. Well, that day has now arrived, and they are helping people formally now. Having a formal session with them put things in perspective for me. My planning was all over the place. They have given me a structure now.